Participation of the PABSEC International Secretariat in the 9th OECD Forum on Green Finance and Investment, online, 5-7 October 2022

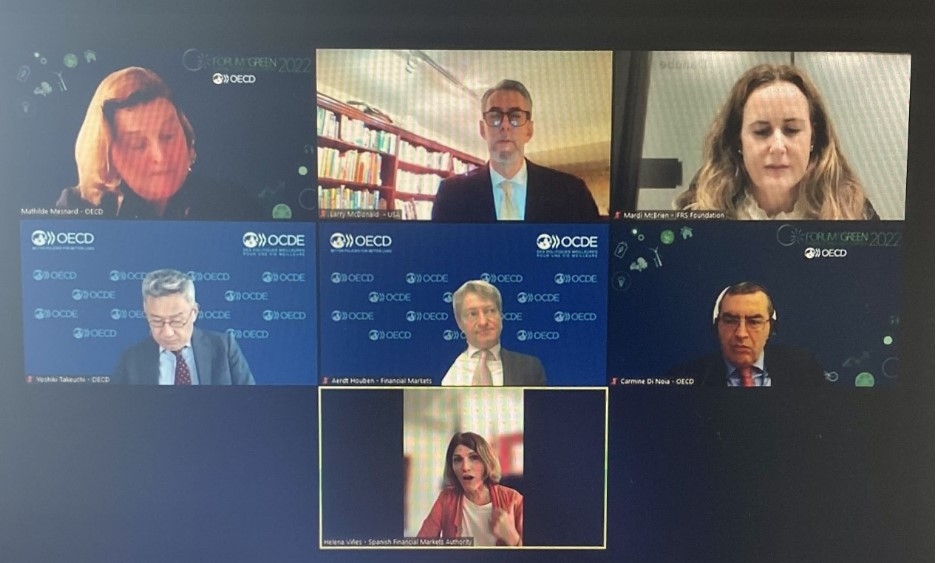

Mr. Miltiadis Makrygiannis, PABSEC Deputy Secretary General, attended the 9th OECD Forum on Green Finance and Investment, online on 5-7 October 2022.

The OECD Forum on Green Finance and Investment is the annual flagship event of the OECD Centre. The event aimed to bring together leading global actors in the financial industry, policymaking, academia, and civil society to advance the green and sustainable finance agenda.

Forum sessions covered a wide range of pressing sustainable finance issues, including: emergence of transition finance; evolution of Environmental, Social, and Governance (ESG) investing; financing infrastructure resilience and adaptation; and integrating biodiversity-related financial risks into decision making.

Some of the topics that were discussed over the three - day Forum was: “Improving Market Practices to Finance a Climate Transition and Strengthen ESG (Environmental, Social and Governance) Investing”, “Financing the responsible retirement of polluting assets”, “Financing infrastructure resilience and adaptation”, “Making the most of subnational green budgeting to mobilise private finance to support climate action”, “Connecting business and financial sector climate commitments to policy”, “Transitioning to net-zero: the role of carbon pricing and corporate income tax”, “Achieving a resilient transition: adapting to physical climate impacts”, “Biodiversity-related financial risks”, “Achieving ambitious climate and energy targets in times of crisis”, “Progress towards the mainstreaming of impact management” etc.

Speakers pointed out that:

- financial markets have a critical role to play in facilitating a climate transition by helping to assess the net benefits, channeling capital to entities that are transitioning to renewables, and providing appropriate surveillance and verification to support an orderly transition to net zero. While noteworthy progress has been made, considerable challenges hinder the efficient mobilisation of capital,

- COP26 and the Glasgow Climate Pact highlighted the urgency of scaling up action and support to enhance adaptive capacity, strengthen resilience and reduce vulnerability to climate change. This raises the need to ensure that infrastructure investments mitigate the impacts of climate change while also building adaptation capacity and resilience. This session will bring together governments to discuss the need to scale up financing for infrastructure resilience,

- Over 97% of sustainable capital is invested in high-income countries. At the same time, emerging markets need investment to help transition assets to green and create investment products to support transition and the right policy incentives are needed to draw capital to low-income countries.

More than 1700 participants from 122 countries attended the forum and more than 100 high level speakers took the floor during the three days event